georgia ad valorem tax out of state

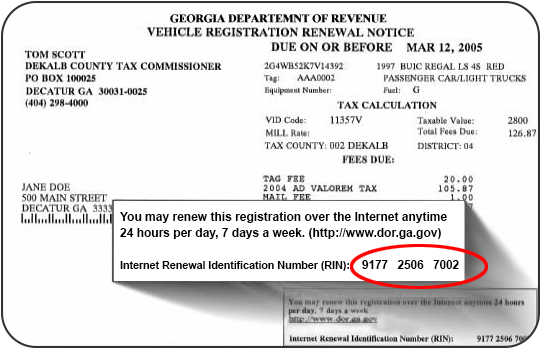

Ad valorem tax georgia. As a result the annual vehicle ad valorem tax sometimes called the birthday tax is being changed to a state and local title ad valorem tax or TAVT.

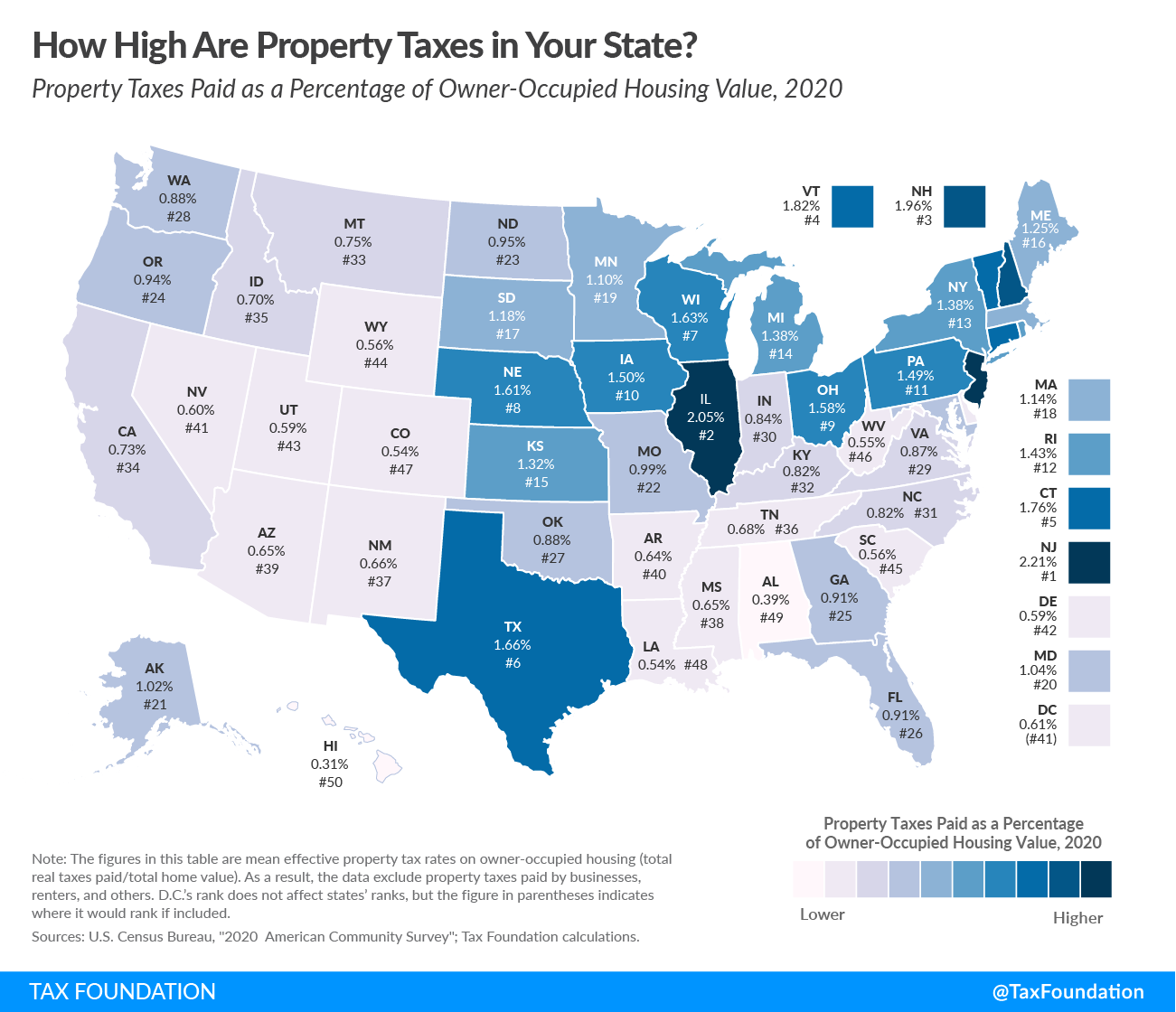

Georgia Tax Rates Rankings Georgia State Taxes Tax Foundation

If you buy a car out of state and register it in Georgia then there is a 4 state sales tax instead of the TAV Tax.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Thereafter there is no annual ad valorem tax but an additional TAVT applies each time.

For the answer to this question we consulted the Georgia Department of Revenue. The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit. The TAVT imposes a title tax at the time of purchase or initial registration in the state.

Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and. Complete Edit or Print Tax Forms Instantly.

As a result the annual vehicle ad valorem tax sometimes called the birthday tax is being changed to a state and local title ad valorem tax or TAVT. You can calculate the Title Ad Valorem Tax by finding the. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter.

The Ad Valorem Tax or the Property Tax is based on value. As of 2018 residents in most Georgia counties pay a one. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Use Ad Valorem Tax. Ad Access Tax Forms. The Georgia Timber Equipment Exempt from Property Taxes Measure on the November 2022 ballot would change the states tax law so that starting Jan.

Motor vehicles registered in Georgia. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Learn how Georgias state tax laws apply to you. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

Property Tax Map Tax Foundation

Kiplinger Tax Map Retirement Locations Retirement Retirement Advice

Georgia New Car Sales Tax Calculator Atlanta City City View Atlanta

New Ga Motor Vehicle Registration System To Be Implemented Next Month Allongeorgia

Remember That You Don T Actually Own Your Property Try Not Paying Your Real Estate Taxes And See Who Comes To Auction Off Property Tax Estate Tax Survey Data

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Utah Enderal

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Retirement Strategies Savings And Investment

Georgia Tax Rates Rankings Georgia State Taxes Tax Foundation

Where Your State Gets Its Money

Georgia Used Car Sales Tax Fees

Us State Tax Revenue Per Capita Data Interestingdata Beautifuldata Visualdata State Tax U S States Information Visualization

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

What Are Ad Valorem Taxes Henry County Tax Collector Ga

Pin By Kirunda Group Corp On Real Estate Investing Being A Landlord Real Estate Investing Property Tax

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Payment Mortgage